Services

Following graduation from Kwansei Gakuin University with a BA degree in law and a MA degree in the United States, Muroya, the author of our products, began creating research reports on Japan’s listed companies as a research analyst at a stockbroker in 1989. During the period of 1993 to 2003, when working as a small-cap analyst at Tokyo branch of Cazenove (headquartered in London), he devoted himself to excavation and identification of listed companies with a high growth potential for the future in order to introduce them to institutional investors in Japan and overseas, which enhanced recognition of all those small-cap companies on a global basis, e.g., Company A to command an overwhelming share in the market for LCD-use films worldwide, Company B to drive miniaturization of semiconductors and Company C to have strengths on high-precision motors and mergers & acquisitions. Then, on 27 October 2009, he set up Walden Research Japan Incorporated, having begun services to provide creation and delivery of sponsored research reports.

Small Cap Excavation

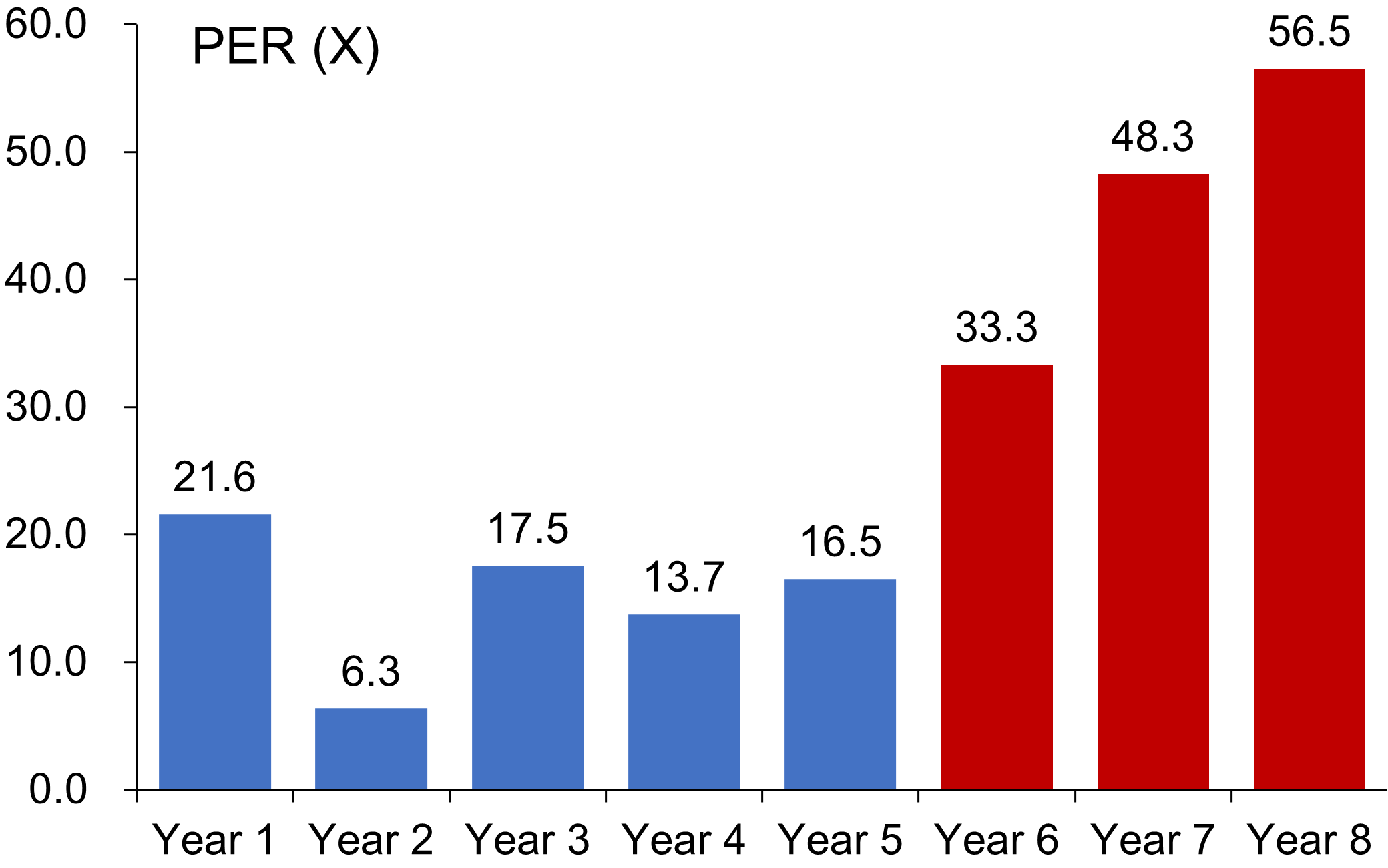

As mentioned above, Muroya, the author of our products, has an expertise to identify small-cap growth companies and improve their recognition on a global basis. The most outstanding case example since the startup of our business is of Company D to run the operations of online shopping. At the stage of IPO, the market cap was limited to some ¥10,000m or less and its prospective high growth potential had been almost ignored in the stock market in those days, due to its limited market cap to a large extent, i.e., PER (fiscal year average) having had never been far higher than 20x over 5 years since the IPO. Meanwhile, for a period of our services from year 6 to year 8, Company D saw a surging PER (fiscal year average), respectively, 33.3x, 48.3x and 56.5x. It appears that our Company Report and Results Update on Company D, created and delivered every quarter in both Japanese and English may have had contributed to improvement of its recognition amongst institutional investors on a global basis. By the way, such a surge of PER has never taken place again to date, as far as we could see.

Platforms to "Pull" and e-mails to "Push"

We create our Company Report and Results Update and deliver both to diverse information platforms with a "pull" nature to wait for viewers to come, including this website, while basically looking to institutional investors in Japan and overseas to invest in Japan’s listed companies based on their fundamental analysis to come and view our products. For those who are heavily involved with investment in Japan’s small cap companies, we deliver our products via e-mail with a "push" nature to appeal directly to the designated targets. By the way, such communications clearly fall solely within the minor non-monetary benefit exemption (for example, written material from a third party that is commissioned and paid for by a corporate issuer to promote a new issuance), i.e., not falling within the scope of the MiFID II regulations, which is well known by anybody.